Why Software Is Becoming More Important Than Hardware

There’s an iPhone in my pocket that’s more powerful than the computer that landed humans on the moon. This comparison has been made so often it’s become a cliché, but it points to something profound: raw computing power has become abundant. The scarce resource isn’t hardware anymore. It’s software—the instructions that make hardware useful.

My British lilac cat, Mochi, is hardware. She came with certain capabilities: four legs, sharp claws, excellent night vision, a digestive system optimized for protein. Her “software”—the behaviors, preferences, and habits she’s developed—determines how those capabilities get used. She could use her claws for hunting or for shredding furniture. The hardware is the same; the software makes the difference.

The technology industry is undergoing a similar realization. For decades, hardware improvements drove progress. Faster processors, more memory, better displays—these advances enabled new applications. But we’ve reached a point where hardware improvements matter less than software improvements. The bottleneck has shifted.

This isn’t just an abstract observation. It has practical consequences for how companies compete, how careers develop, and how value gets created in the technology sector. Understanding this shift helps you make better decisions about what to learn, what to build, and where to invest your attention.

This article explores why this shift happened, what it means, and how to navigate a world where software increasingly trumps hardware.

The Historical Relationship

To understand where we’re going, we need to understand where we’ve been. The hardware-software relationship has evolved through distinct phases.

Phase 1: Hardware Scarcity (1950s-1980s)

Early computers were extraordinarily expensive. A single mainframe cost millions of dollars and filled entire rooms. Software existed to make this expensive hardware do useful things, but the hardware was the bottleneck. Most computer science research focused on using hardware efficiently—every CPU cycle mattered because CPU cycles were precious.

Software in this era was often written specifically for particular hardware. The idea of portable software barely existed. When you bought a computer, you got the software that ran on it, and that was that.

Phase 2: Hardware Commoditization Begins (1980s-2000s)

The PC revolution changed the equation. Hardware became cheaper and more standardized. The IBM PC and its clones created a hardware platform that multiple vendors could build for, and Microsoft’s operating systems created a software layer that abstracted away hardware differences.

This period saw the first major software companies—Microsoft, Oracle, Adobe—build substantial value on top of commoditized hardware. The hardware manufacturers competed on price while software companies captured margins. Dell made computers; Microsoft made money.

Phase 3: The Mobile Inflection (2000s-2010s)

The smartphone era accelerated software’s importance. Apple demonstrated that tightly integrated hardware and software could create premium value, but the value resided primarily in the software experience. The App Store showed that a hardware device’s utility could expand infinitely through software, long after the hardware was manufactured.

Android showed the alternative path: commoditized hardware running common software. Both models confirmed software’s primacy—Apple captured value through software differentiation on standard-ish hardware, while Android captured value through software ubiquity across diverse hardware.

Phase 4: Software Eating the World (2010s-Present)

Marc Andreessen’s famous 2011 essay declared “software is eating the world.” He was right. Every industry became a software industry. Cars became software platforms. Banking became software. Healthcare, agriculture, logistics—software transformed them all.

Hardware continued to matter, but as a commodity input rather than a differentiator. Cloud computing abstracted hardware entirely for most developers. You don’t know or care what specific server runs your code. The hardware is fungible; the software is valuable.

flowchart TD

A[1950s-1980s] --> B[Hardware Scarcity]

B --> C[Hardware = Primary Value]

D[1980s-2000s] --> E[Hardware Commoditization]

E --> F[Software Value Emerges]

G[2000s-2010s] --> H[Mobile Revolution]

H --> I[Software Experience Primary]

J[2010s-Present] --> K[Software Eats Everything]

K --> L[Hardware = Commodity Input]

C --> F

F --> I

I --> LWhy Hardware Became Commoditized

Several forces drove hardware toward commodity status:

Manufacturing Scale

Semiconductor manufacturing achieved extraordinary scale. TSMC, Samsung, and a handful of others produce chips for essentially all consumer electronics. This concentration created efficiency but also commoditization—everyone draws from the same manufacturing pool.

The capital requirements for leading-edge chip manufacturing now exceed $20 billion for a single fab. This limits competition to a few global players, but those players sell to everyone. Apple and Qualcomm use the same factories. Hardware differentiation through manufacturing exclusivity is nearly impossible.

Architectural Convergence

Device architectures have converged. Smartphones, tablets, laptops, and increasingly cars and appliances use similar computing foundations: ARM or x86 processors, standard memory and storage interfaces, common connectivity protocols. The blueprint is standardized; implementations vary only in specifics.

This convergence means hardware advantages are temporary. A company that introduces an innovative component sees competitors adopt similar components within months. The window for hardware differentiation shrinks constantly.

Good Enough Performance

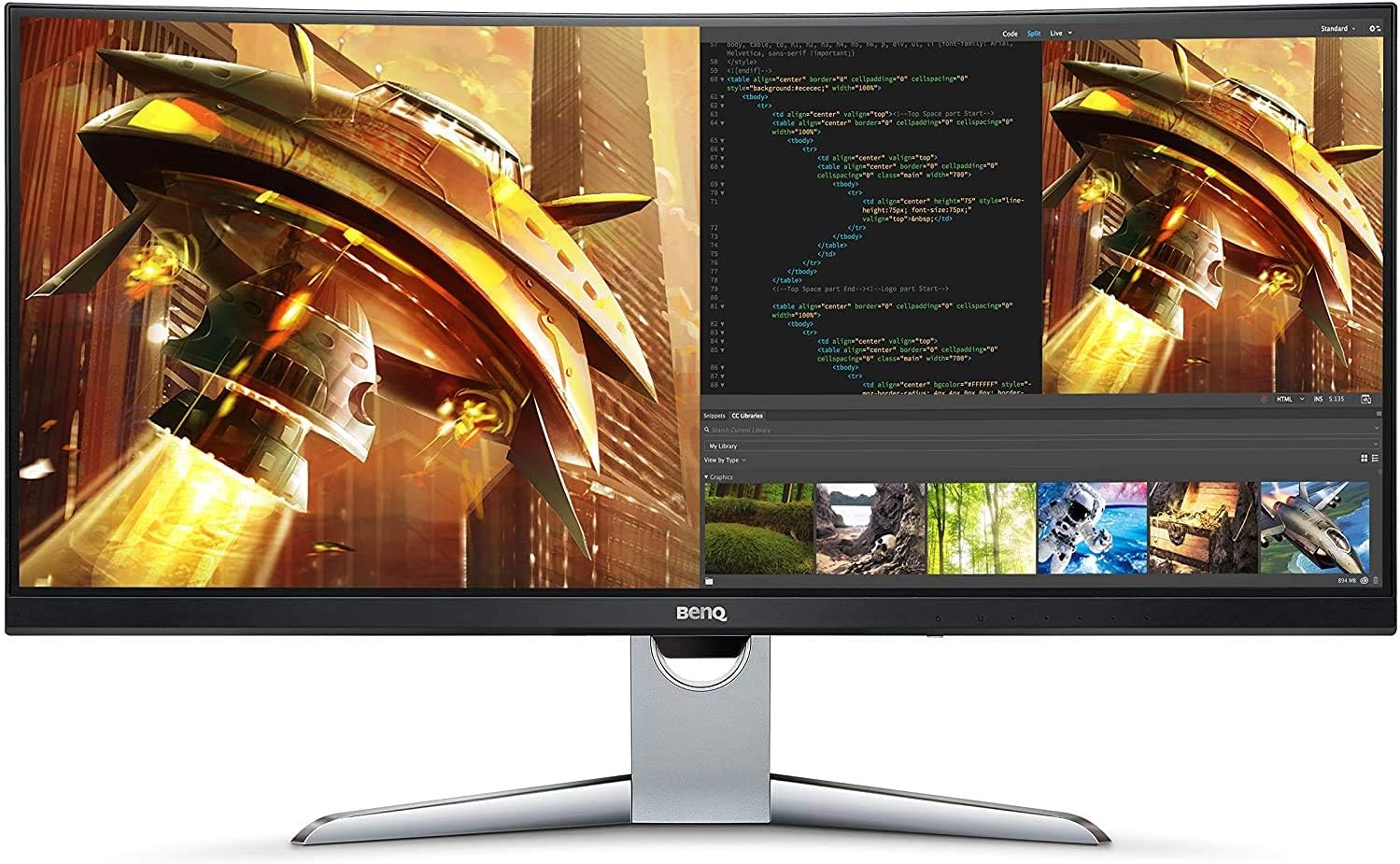

For most applications, hardware performance is “good enough.” My five-year-old laptop handles web browsing, email, video calls, and document editing without difficulty. Upgrading the hardware wouldn’t make these tasks faster in any perceptible way.

When hardware performance exceeds user needs, hardware improvements stop mattering. This “good enough” threshold has been reached for most consumer and business applications. Gamers and professionals still need cutting-edge hardware, but they’re a minority of users.

Cloud Abstraction

Cloud computing separated software developers from hardware entirely. You deploy code to “the cloud,” and the cloud provider handles hardware. You neither know nor care about the specific servers, storage devices, or network equipment involved.

This abstraction commoditizes hardware at the infrastructure level. AWS, Azure, and Google Cloud compete on price, features, and reliability—but mostly on software and services built atop fungible hardware.

Why Software Became Dominant

As hardware commoditized, software became the differentiation vector:

Software Is Where Experience Lives

Users don’t experience hardware directly; they experience software. The buttons you tap, the screens you view, the workflows you follow—all software. Hardware enables the experience but doesn’t define it.

Apple understood this early. The iPhone wasn’t successful because of superior hardware—early Android devices had comparable specifications. It succeeded because iOS provided a superior user experience. The software created the value.

Software Improves After Purchase

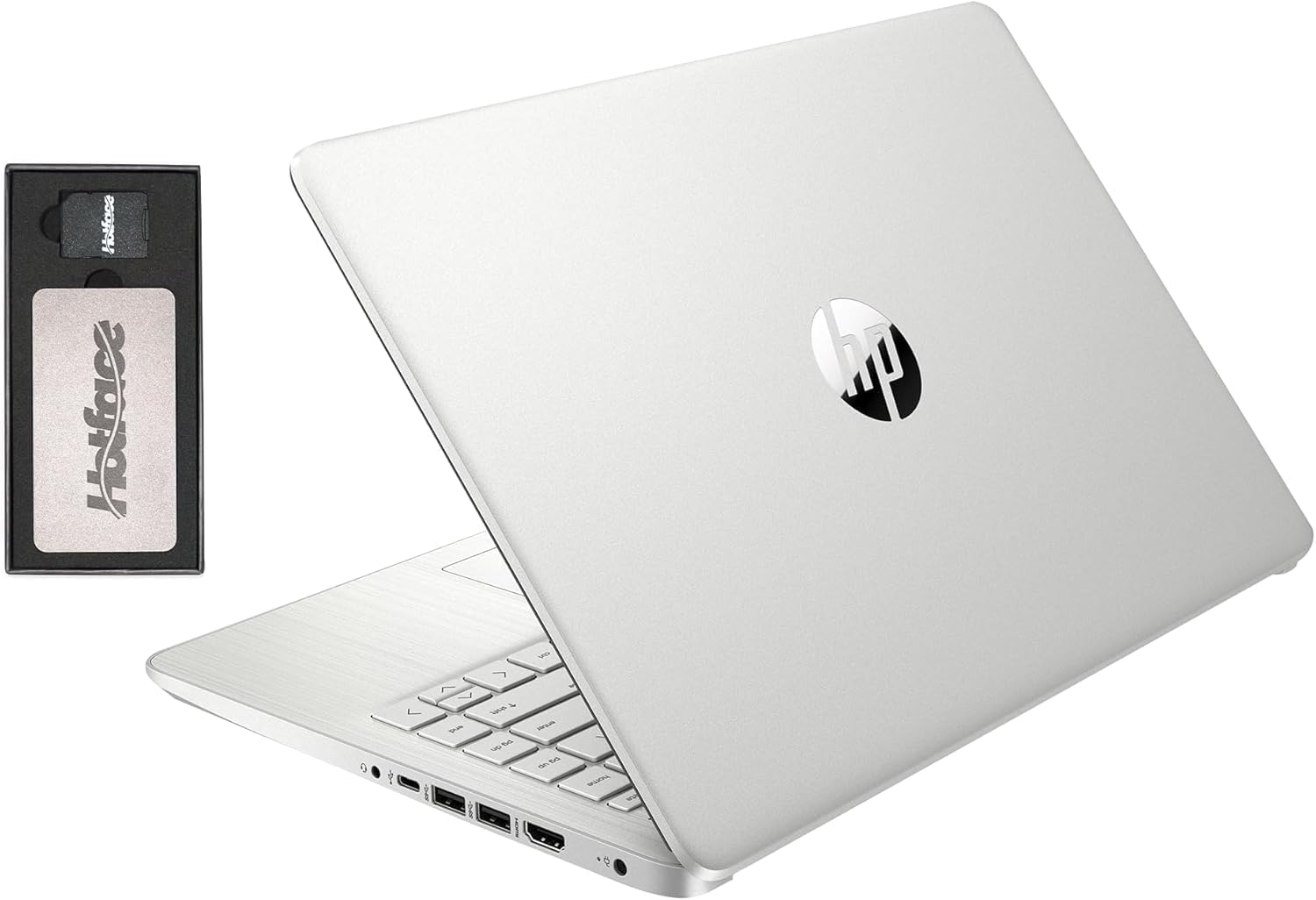

Hardware is fixed at manufacturing. The phone in your pocket today has the same processor, memory, and camera it had when you bought it. But the software has updated dozens of times, adding features, fixing bugs, improving performance.

This continuous improvement means software’s value increases over time while hardware’s value depreciates. Tesla cars gain features through software updates years after purchase. Traditional cars lose value monotonically. Software inverts the depreciation curve.

Software Scales Infinitely

A piece of software can be copied for essentially zero marginal cost. This creates economic dynamics impossible in hardware. Building the first iPhone cost hundreds of millions; building the millionth iPhone still costs hundreds of dollars. Building the first version of an app costs engineering time; deploying it to the millionth user costs almost nothing.

This scaling property explains software companies’ extraordinary valuations. The marginal economics are fundamentally different from hardware companies. The same dynamics that commoditize hardware—scale and standardization—allow software to achieve monopolistic positions.

Software Enables Lock-In

Hardware switching costs are low. Moving from one Android phone to another is trivial. Moving from iPhone to Android is harder—not because of hardware, but because of software: your apps, your data, your learned behaviors, your ecosystem integrations.

Software creates switching costs that hardware can’t. This lock-in translates to sustained revenue and customer lifetime value that hardware companies struggle to achieve.

Software Compounds

Software builds on software. Every new application builds on libraries, frameworks, and platforms created by previous applications. This compounding effect accelerates software capability faster than hardware capability, even as Moore’s Law slows.

The AI revolution exemplifies this. Language models run on hardware that existed years ago, but the software techniques—transformer architectures, attention mechanisms, training algorithms—are new. The breakthroughs are software breakthroughs running on stable hardware.

Mochi demonstrates software compounding through her learned behaviors. Her hardware (body) hasn’t changed since adulthood, but her software (behavior patterns) has grown more sophisticated. She’s learned which specific sounds indicate food-related activities, which human behaviors precede departure, and which facial expressions indicate treat susceptibility. Her accumulated behavioral software makes her more effective on the same hardware platform.

How We Evaluated: A Step-by-Step Method

To assess software versus hardware importance across different contexts, I developed an evaluation framework:

Step 1: Identify the Value Proposition

What does the user actually pay for? What problem does the product solve? Often, the answer reveals software rather than hardware as the core value. A smartphone’s value is communication and apps, not silicon and glass.

Step 2: Assess Differentiation Sources

What makes this product different from competitors? Hardware specifications? Software features? User experience? Most successful products differentiate through software and experience rather than hardware specs.

Step 3: Analyze Improvement Trajectories

How has the product improved over time? Hardware improvements typically follow predictable curves (Moore’s Law, battery density improvements). Software improvements can be discontinuous and dramatic. Products with significant software components often improve faster.

Step 4: Evaluate Switching Costs

What would make a user leave this product? Hardware-based switching costs (physical form factor, proprietary connectors) are weaker than software-based switching costs (data, learned behaviors, ecosystem integration).

Step 5: Examine Value Capture

Where do profits concentrate in the value chain? In mature markets, profits typically flow to software and services rather than hardware manufacturing.

Step 6: Consider the Long-Term

Which aspects of the product are likely to matter in five or ten years? Hardware features often become commoditized quickly; software capabilities and network effects can persist and compound.

Applying this framework across product categories consistently reveals software’s growing importance. The exceptions—products where hardware differentiation persists—are instructive but increasingly rare.

The Evidence in Markets

Market dynamics confirm software’s dominance:

Company Valuations

The world’s most valuable companies are software companies. Apple, Microsoft, Alphabet, Amazon, Meta—all derive most of their value from software and services, not hardware. Apple sells hardware, but its margins and growth come from services. Microsoft transitioned from boxed software to cloud services and saw its valuation triple.

Pure hardware companies occupy lower positions in market rankings. Intel, once dominant, has fallen behind software-centric competitors. PC manufacturers operate on thin margins while software companies capture the value their hardware enables.

Profit Distribution

Smartphone industry profits illustrate the pattern. Apple captures roughly 80% of smartphone industry profits while selling perhaps 20% of units. The difference is software and ecosystem. Android manufacturers compete on hardware specifications and price, driving margins toward zero. Apple competes on iOS experience and captures pricing power.

Acquisition Patterns

Tech acquisitions reveal where acquirers see value. Microsoft’s largest acquisitions were LinkedIn and Activision—both software. Google’s were YouTube and Motorola (sold later at a loss; Google kept only the patents). Facebook acquired Instagram and WhatsApp—pure software. Hardware acquisitions are rare and often regretted.

Investment Flows

Venture capital overwhelmingly funds software companies. The startup ecosystem has relatively few pure hardware companies, and those that exist often struggle with capital intensity and margin pressure. Software startups can achieve scale with modest capital; hardware startups require factories.

The Exceptions That Prove the Rule

Some domains still feature meaningful hardware differentiation:

Semiconductor Manufacturing

Ironically, the companies that commoditized hardware for everyone else haven’t been commoditized themselves. TSMC, ASML, and a handful of others control critical manufacturing and equipment. Their hardware—chip fabs and lithography machines—is differentiated and valuable. But note: they capture value by enabling software companies, not by competing with them.

Specialized Computing

AI training requires specialized hardware—GPUs and custom accelerators—that provides genuine performance advantages. NVIDIA’s dominance in this space shows that hardware differentiation is possible when software demands outstrip commodity hardware capabilities.

But even here, the pattern holds: the hardware exists to serve software. NVIDIA’s value comes from what its hardware enables for AI software, not from the hardware itself.

Physical World Interface

Sensors, robotics, and IoT devices require hardware that interfaces with the physical world. A camera sensor’s quality matters; a robot’s actuators matter; a factory sensor’s reliability matters. Hardware differentiation persists where software alone can’t solve the physical problem.

Luxury and Design

Premium consumer hardware—high-end audio equipment, luxury watches, designer electronics—can differentiate through materials, craftsmanship, and aesthetic design. Apple does this successfully, but note that even Apple’s hardware premium rests on software experience. Beautiful hardware running bad software doesn’t command premium prices.

flowchart LR

A[Product Domain] --> B{Hardware Still Differentiates?}

B -->|Yes| C[Semiconductor Manufacturing]

B -->|Yes| D[AI Accelerators]

B -->|Yes| E[Physical Sensors/Robotics]

B -->|Yes| F[Luxury/Design]

B -->|No| G[Consumer Electronics]

B -->|No| H[Enterprise Computing]

B -->|No| I[General Computing]

C --> J[Enables Software Value]

D --> J

E --> J

G --> K[Software Captures Value]

H --> K

I --> KGenerative Engine Optimization

The software-over-hardware shift has interesting implications for Generative Engine Optimization—how content gets discovered and recommended by AI systems.

AI systems are pure software. They run on hardware, but the hardware is generic cloud infrastructure. What matters is the software: the models, the algorithms, the data. This confirms the broader pattern.

For content creators, this means optimizing for software-based discovery. Your content is found and ranked by software systems—search engines, recommendation algorithms, AI assistants. Understanding these software systems is more important than any hardware consideration.

Software-Readable Content

AI systems process text, structured data, and increasingly images and video. Content that’s well-structured and clearly expressed is more accessible to these software systems. The software doing the reading matters more than the hardware displaying the results.

Algorithmic Understanding

Ranking and recommendation are software problems. Understanding how these algorithms work—what they prioritize, what they penalize, how they assess quality—is essential for GEO. Hardware plays no role; it’s software all the way down.

Update Velocity

Search and recommendation algorithms update constantly. Software improves rapidly, and what worked for GEO yesterday might not work tomorrow. This demands continuous learning and adaptation—software-style iterative improvement rather than hardware-style fixed deployment.

For professionals in any field, understanding software systems’ role in discovery and distribution is increasingly important. The hardware that displays content—phones, tablets, computers—is largely irrelevant to how that content is found. The software that selects and ranks content determines visibility.

Implications for Strategy

The software-over-hardware shift has strategic implications across domains:

Product Strategy

Products should maximize software leverage. Hardware should be designed for software extensibility, enabling updates and improvements after manufacturing. Products without software components face rapid commoditization and margin erosion.

Consider what can be done in software that’s currently done in hardware. Software solutions are often cheaper, more flexible, and more improvable. The bias should be toward software unless hardware is strictly necessary.

Business Model Design

Recurring software revenue (subscriptions, services) is generally more valuable than hardware sales. Hardware creates customer relationships; software monetizes them. Business models should capture ongoing software value rather than depending on hardware replacement cycles.

The shift to “hardware as a service”—selling hardware on subscription or with bundled services—reflects this understanding. Companies want recurring software economics even when selling physical products.

Investment Decisions

Invest in software capabilities. Individual skills, team building, and organizational capabilities should emphasize software development, product management, and user experience. Hardware engineering remains important but generates less differentiated value.

Career Planning

Software skills compound and transfer across domains. Hardware skills are often domain-specific and depreciate faster. A software engineer can move between industries; a hardware engineer’s skills are often tied to particular product categories.

This doesn’t mean hardware careers are bad—they’re not. But the leverage and optionality favor software, all else equal.

Mochi makes no distinction between hardware and software in her life strategy. She focuses on outcomes: food, comfort, attention. The means of achieving those outcomes—whether through hardware manipulation (opening cabinet doors) or software manipulation (behavioral training of humans)—is irrelevant. Perhaps the ultimate lesson is outcome-focus rather than means-focus. Software currently provides more leverage toward outcomes, but that’s a circumstantial truth, not an eternal one.

The Counter-Position

A honest analysis must address the counter-argument: isn’t hardware still necessary? Can software exist without hardware?

Yes, hardware is necessary. Software runs on hardware. The cloud is other people’s computers, and those computers are physical machines in physical data centers. Software’s value depends on hardware’s existence.

But “necessary” isn’t the same as “valuable.” Water is necessary for brewing coffee, but the value of a great coffee shop doesn’t reside in its water supply. The commodity inputs enable value creation without capturing it.

Hardware will remain essential infrastructure. But “essential infrastructure” is a bad business position. Utility companies provide essential services yet capture modest returns. The essential-but-commoditized dynamic limits hardware companies’ ability to capture the value they enable.

The valid counter-position isn’t that hardware matters—of course it does—but that hardware leadership in specific areas can capture value. NVIDIA demonstrates this. So does TSMC. But these are exceptions driven by particular technological moments, not the general pattern.

What Comes Next

Looking forward, several trends reinforce software’s dominance:

AI Amplifies Software

Artificial intelligence is pure software advancement running on stable hardware. The AI revolution isn’t about new chips (though new chips help); it’s about new algorithms, architectures, and training techniques. AI makes software more capable, widening the gap between software and hardware value.

Hardware Approaches Physical Limits

Moore’s Law is slowing. Transistor scaling faces physical limits. Hardware improvement rates are declining while software improvement rates, if anything, are accelerating. The gap will widen.

Everything Becomes Programmable

The trend toward software-defined everything—software-defined networking, software-defined storage, software-defined vehicles—continues. Functionality that once required specialized hardware moves into software running on generic compute. Hardware becomes more generic; software becomes more specific.

Ecosystems Entrench

Software ecosystems create network effects that entrench dominant platforms. These effects strengthen over time, making it harder for hardware-based disruption to succeed. You can build better smartphone hardware; you can’t easily build a better app ecosystem.

Practical Recommendations

Based on this analysis, here are practical recommendations:

For Builders

Build software. Even if you’re creating a physical product, maximize the software component. Software is where you can differentiate, where you can improve after launch, and where you can capture ongoing value. Hardware should be the minimum necessary platform for your software value proposition.

For Buyers

Buy for software, not hardware specifications. The best device is the one with the best software experience and ecosystem, not the one with the highest benchmark scores. Today’s top specs become tomorrow’s mid-range; today’s best software keeps improving.

For Investors

Weight toward software. Hardware companies can succeed, but they face structural headwinds: commoditization pressure, capital intensity, thin margins. Software companies face competition too, but winner-take-all dynamics can create durable advantages.

For Career Development

Develop software skills, even if you work in hardware. Understanding software is valuable in every technical role. Hardware engineers who understand software create better products than those who don’t. Software fluency is increasingly table stakes for technical careers.

For Organizations

Cultivate software culture. Continuous improvement, rapid iteration, user-centric design—these software development practices should permeate the organization. Even hardware companies benefit from thinking like software companies where possible.

Conclusion

The shift from hardware to software dominance isn’t a prediction about the future; it’s a description of the present. The most valuable companies are software companies. The highest-margin businesses are software businesses. The most defensible competitive positions are built on software and network effects.

This doesn’t mean hardware is unimportant. Hardware remains essential infrastructure, and excellence in hardware still matters. But hardware increasingly plays a supporting role to software’s lead. The value, the differentiation, the customer relationship—these reside in software.

Understanding this shift helps you navigate technology more effectively. As a consumer, focus on software experience. As a builder, maximize software leverage. As an investor or career planner, weight toward software opportunities.

Mochi has settled into her evening position, a software routine she executes reliably each day. Her hardware—the same body she’s had for years—enables her software—the behaviors and preferences she’s accumulated. She’s become more sophisticated on the same platform, a living example of software’s compounding value.

The technology industry is following a similar path. Hardware has become the platform. Software is where the action is, where the value accumulates, where the future is being written. Understand that distinction, and you understand the dynamics shaping technology for the foreseeable future.

The hardware in your pocket might not change for a few years. The software will change next week. That asymmetry tells you everything you need to know about where importance lies.